Expanding an online business into new markets can be a daunting task, particularly when you’re dealing with the complexities of VAT registrations, VAT filings and extended producer accountability. With the right tools and with support this process can be made much easier. Staxxer is a complete solution that serves as a one-stop shop for all your VAT and EPR requirements. This ensures seamless and efficient operations in Europe for ecommerce sellers.

VAT Compliance The Challenges

Compliance with VAT is an important aspect of operating an online business in Europe. Each country has its own VAT regulations and to remain compliant, you have be aware of. Companies that sell on e-commerce must register with the VAT authorities in every nation in which they operate and file regular VAT tax returns and accurately calculate VAT. This is a lengthy procedure that is vulnerable to error, depleting precious resources away from the core tasks of business.

Staxxer is your one-stop source for VAT Compliance

Staxxer simplifies compliance with VAT by offering an all-in-one solution for registration and submission of VAT. Through automation of these processes, Staxxer lets e-commerce sellers focus on growth and expansion with no burden on administration. Staxxer helps to automatize the VAT compliance process.

Automated VAT registration: In order to expand into a different country it is necessary to register for VAT in the specific country. Staxxer simplifies the process of registration to ensure that the local laws are in line with regulations.

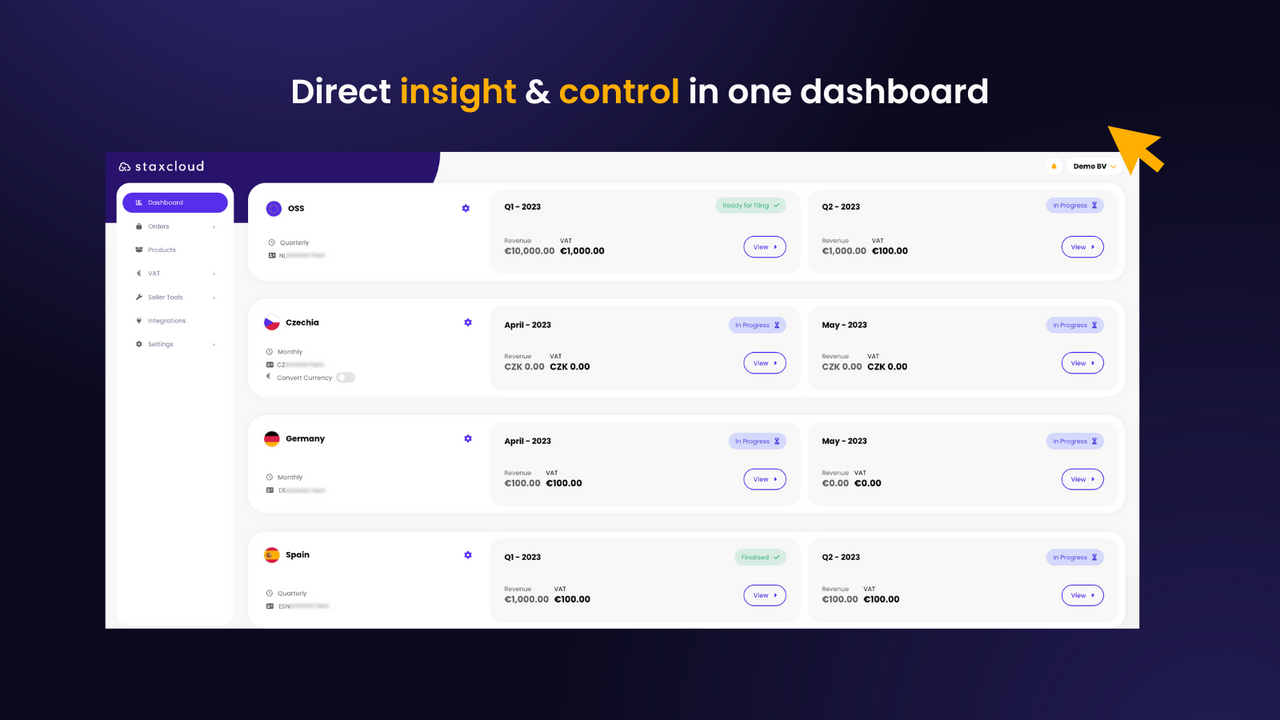

Efficient VAT Filings: Regular VAT filings must be completed for companies operating in Europe. Staxxer automates the process of VAT filing which ensures timely and accurate submissions. The platform integrates with all sales channels and combines data to calculate VAT in every country down to the final penny.

Staxxer offers a comprehensive VAT management solution, from calculating VAT to managing declarations. This end-to-end management ensures that businesses remain compliant without committing significant time and resources in VAT-related duties.

Role of extended producer responsibility (EPR).

Extended Producer Responsibility (EPR) is an environmental policy approach that holds producers responsible for the entire lifecycle of their products, including disposal and recycling. That means that online retailers must abide by regulations related to electronic wastes, and various types of waste that are specific to the products.

Staxxer’s EPR Solutions

Staxxer’s expertise extends beyond EPR compliance as well. Here’s how Staxxer assists businesses in managing their EPR obligations:

Automated EPR Compliance: Staxxer’s platform integrates EPR compliance with its services that automate the reporting and management of waste obligations. It ensures that companies comply with environmental regulations, and without adding the burden of administration.

EPR requires comprehensive reporting of the different types and amounts of waste that are generated. Staxxer’s program simplifies this process by consolidating data and generating accurate reports, ensuring the compliance of local and international regulations.

Sustainable Business Practices. Businesses can boost their sustainability by focusing on EPR requirements in a way that is efficient. Staxxer’s solutions can help companies reduce their environmental footprint while also promoting environmentally responsible production and disposal methods.

Why Entrepreneurs Choose Staxxer

Entrepreneurs and e-commerce businesses select Staxxer because of its broad and automated solutions to simplify VAT and EPR compliance. Here are some key benefits.

Automating VAT filings as well as EPR Compliance allows businesses to spend more time to expand and grow. Staxxer’s solutions eliminate manual data entry tasks and administrative duties.

Staxxer’s platform provides accurate VAT calculations across all countries. This helps reduce the risk of errors and penalties. The accuracy is vital to ensuring compliance and avoiding costly errors.

User-friendly: Staxxer’s user-friendly interface, seamless integration with various sales channels make it easy for companies and their employees to keep track of their VAT obligations as well as EPR obligations. The platform’s intuitive design simplifies complex processes, making compliance straightforward.

Staxxer helps businesses run in confidence knowing that they’re in compliance with all regulations. Entrepreneurs looking to expand their business without having to worry about regulations will find this security invaluable.

The final sentence of the article is:

Staxxer is a single-stop shop for businesses looking to simplify their compliance with EPR and VAT. Staxxer helps automate VAT registration, filings and EPR obligations. It allows companies to concentrate on expansion and growth. Staxxer’s comprehensive platform ensures accuracy in calculation, prompt submission and long-term sustainability and makes it a perfect option for entrepreneurs who wish to expand without difficulty. Staxxer provides a range of solutions that make ensuring compliance simple.